Toby Toler answered his phone in late April, soon after Dallas Central Appraisal District sent out property tax appraisal notices to everyone in Dallas County.

On the other line was Shellie Ross, executive director of Wesley-Rankin Community Center, situated within West Dallas’ Los Altos neighborhood. The 120-year-old neighborhood-based nonprofit owns a few different parcels, most of them tax exempt because of Wesley-Rankin’s 501c3 status. But a vacant lot across the street from the center isn’t exempt.

In 2017, DCAD valued the lot at $11,700. In 2018 and 2020, that number jumped to $50,000 then $65,000, simultaneous with other property value spikes throughout historically redlined West Dallas, where land values hovered at next-to-nothing for decades. DCAD valued that same lot at $2,500 in 2000.

When Ross received this year’s appraisal, however, it gave her sticker shock — the value of the vacant lot had nearly tripled to $168,000, which meant their property tax bill had nearly tripled, too.

A few years ago, when values initially rose, Wesley-Rankin hosted property tax and title workshops with Toler to educate neighbors. A 30-year veteran in property tax appeals, Toler and his son, Will, amped up their pro bono work in 2018, starting with the historically Black planned community of Hamilton Park, adjacent to the Toler family’s Lake Highlands neighborhood. West Dallas residents, who are predominantly Latino and Black, caught wind of those efforts and reached out to the Tolers for help in their community, too.

So Ross asked Toler if he would again lead a clinic, this time to show West Dallas neighbors how to file a protest.

“A few years ago, it was more of a prevention. We saw the apartments going up [on Singleton] and the land prices rising,” Ross says. “At this point, it’s intervention. We are dealing with much higher numbers than we were three or four years ago.”

Wesley-Rankin isn’t unique. The land value of dozens of 7,000-square-foot parcels in Los Altos — just north of Singleton, up and down Borger, Crossman and Winnetka — all jumped from $65,000 to $168,000 this year. Ross and her team began hearing from neighbors with questions on what could be done about the ensuing property taxes they would have to pay.

“Knowing that protest process could make or break someone staying in West Dallas,” Ross says.

After Ross called, Toler took a look at a parcel owned by a client who lives in the heart of Highland Park. Not surprisingly, the land in Texas’ wealthiest neighborhood was valued much higher — $156.50 a square foot, compared to $24 in Los Altos.

What surprised Toler, however, was that unlike West Dallas neighbors, his Highland Park client’s land values hadn’t changed in five years.

“This scenario repeats itself all across large sections of Highland Park — not all of it, but lots of it,” Toler says. “Are we to think in five years, the appraised value of a superbly located lot in Highland Park flatlined while West Dallas skyrocketed?”

“I’ve never seen any dirt go up 1400% in five years,” Toler says of the Los Altos lots.

One big difference between Highland Park and West Dallas is the number of people who protest their property appraisals, Toler says. Four years ago, when Toler started working in Hamilton Park, he sought a comparison and found that 95% of Highland Park residents had filed protests, while the inverse was true in Hamilton Park — only 5% of residents had protested. Toler assumes the percentage would be similar in West Dallas.

“And if you don’t protest,” he says, “DCAD assumes that’s because they made the correct valuation.”

DCAD’s deadline to file a protest is this coming Monday, May 16. Dallas Free Press built the following explainer to show “How to protest your property tax appraisal in Dallas County,” based on Toler’s clinic this past Monday night:

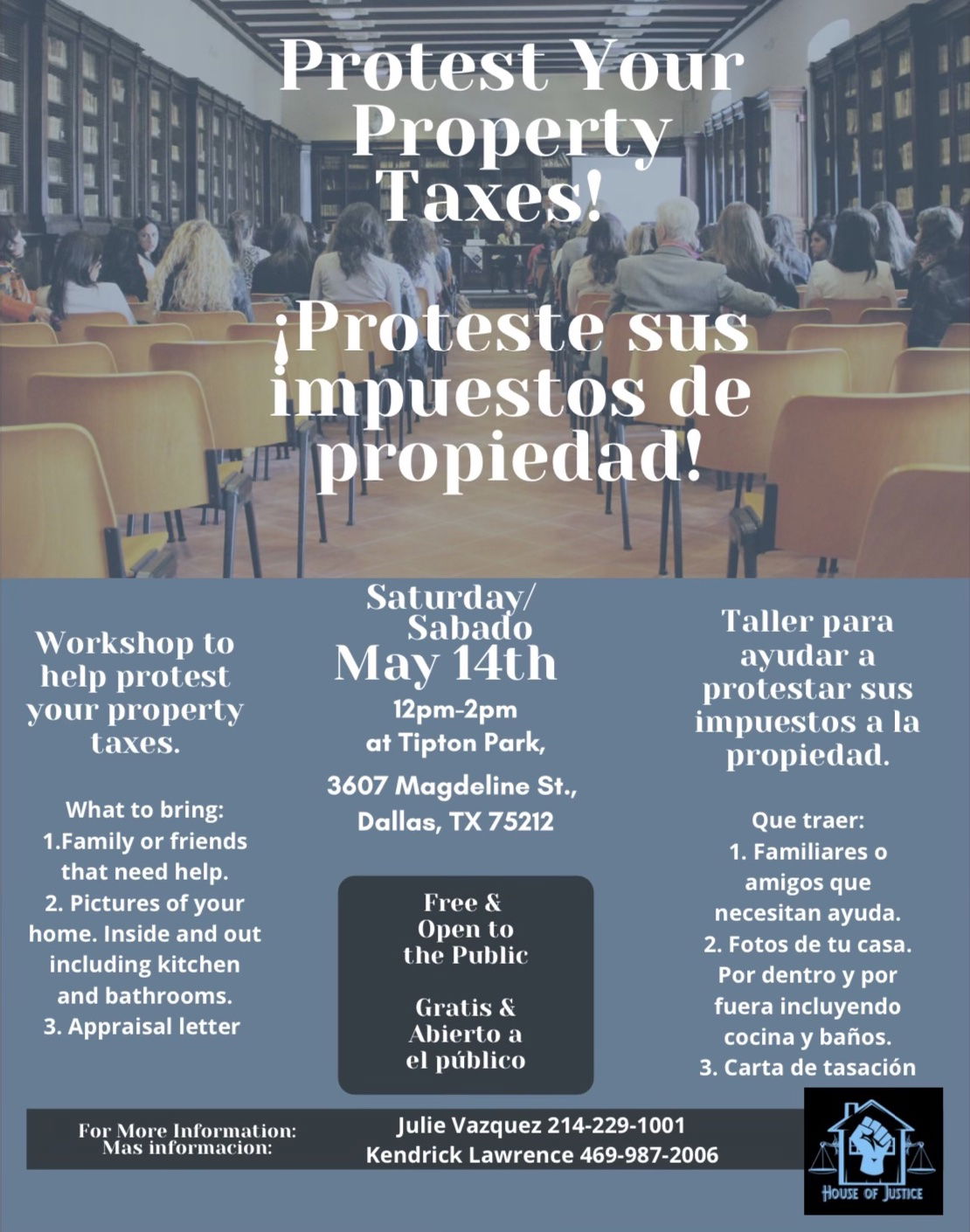

Another opportunity for West Dallas neighbors to ask questions and learn about protesting property taxes is coming up at a workshop hosted by House of Justice this Saturday, May 14, noon-2 p.m. at Tipton Park, 3607 Magdelene St., 75212.

Leave a Reply