Co-published by our media partner, The Dallas Weekly

Mayor Eric Johnson and District 3 Councilman Casey Thomas spent Friday morning on group phone calls with Dallas clergy and small minority-owned business owners, making sure they knew about grants and loans available to them and their communities.

The federal government gave the City of Dallas $5 million in its coronavirus relief bill to distribute to small businesses in grants and loans. The application opens Monday, May 4 at 9 a.m. and closes Monday, May 11 at 11:59 p.m.

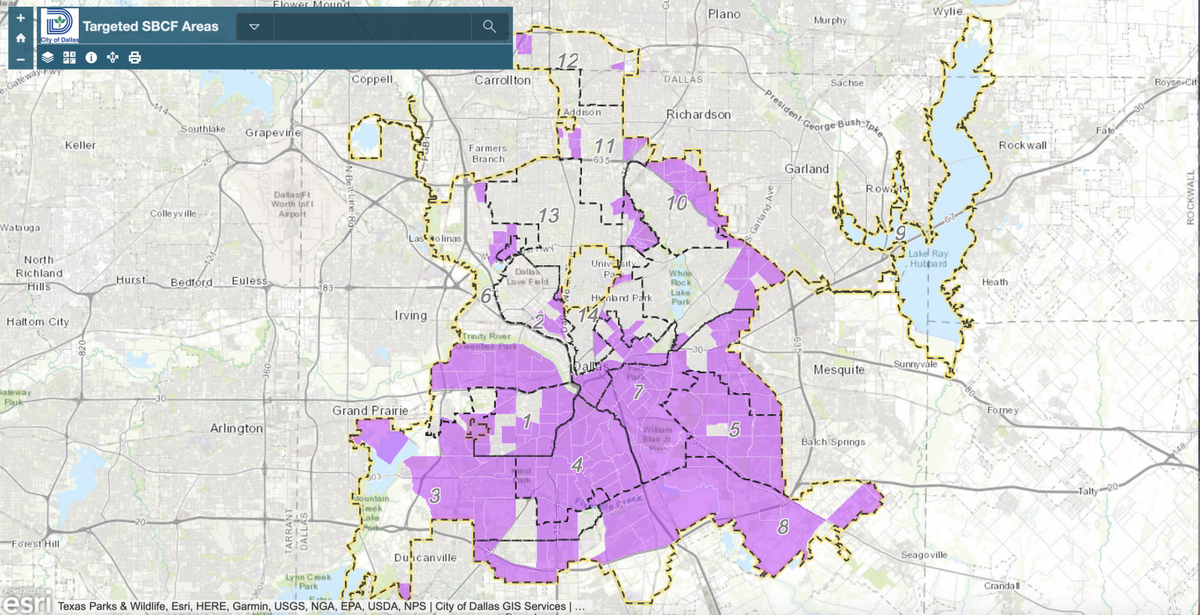

Half of this money, $2.5 million, is set aside specifically for African American and Latino business owners in historically underrepresented communities, said Thomas, who chairs the city’s ad-hoc committee on COVID-19 economic recovery and assistance.

“I did not run for mayor, and I know Chairman Thomas didn’t run for the city council, for us not to take care of the communities who produced us,” said Johnson, who grew up in Oak Cliff and West Dallas and is the city’s second African American mayor.

“That’s not something I run away from,” he said. “That’s something I embrace.”

Johnson told the 47 people on the call that he wants to ensure the coronavirus relief funds don’t follow the same historical patterns of inequity, “which is for us to get the information late and show up at the back of the line and, by the time we get to the window, the money’s gone.”

“We’re going to make sure our communities get their fair share,” Johnson said.

Thomas noted that the city is “putting our people first,” a message he has echoed repeatedly in virtual town halls. He emphasized that the city is “utilizing a lottery system, that way it’s not about those who are first in line. It’s about making sure we have this done in an equitable and fair manner.”

“I know you’re hurting right now,” Thomas told those on the call. “We didn’t see this coming, so we want to be able to provide support and assistance as we can.”

The city also has another $6.1 million fund for individuals who were laid off or whose salaries were cut since the pandemic, to help them with mortgage payments, utility bills and rent. Applications for both relief funds will open next week.

“People often feel — and rightly so — that things that happen at City Hall are aimed at the big, big businesses in this city, the large corporations, the Fortune 500 companies,” Johnson said at the close of the call. “The truth is, the numbers show it’s the small businesses where most of the people in our city are employed, so to me it’s always been problematic that our focus is on the big companies that make up the skyline and have the big offices downtown. That’s not how our economy works.”

Mortgage and Rental Assistance Program

Who does this support?

Dallas residents facing eviction or foreclosure because of job loss due to COVID-19

How much money will be given out?

Up to $13.7 million from combined federal government and city funds

How much money can a an individual or family receive?

Up to $1,500 a month for three months toward mortgage payments, rent or utility fees

What is the application process?

Homeowners and tenants can undergo a pre-screening process at dallascityhall.com or by calling 469.749.6500.

What documents need to be provided?

- Proof of job loss, income reduction, or healthcare/household expense increase

- Passport, state ID or driver’s license for household adults

- Birth certificate for children

- Proof of income

- Proof of occupancy

- Mortgage statement, lease, eviction notice (if applicable)

Small Business Continuity Fund

Who does this support?

- Low- to-moderate incomemicroenterprise business owners with five or fewer employees

- Small businesses with 50 or fewer employees that retain low-to-moderate income employees

- Low-to-moderate income is defined as $46,550 or less a year for a single person or, for example, $68,950 or less for a family of four.

How much money will be given out?

- $5 million from the federal coronavirus relief fund, including:

- $2.5 million for a minimum of 250 grants

- $2.5 million for a minimum of 50 loans

- Half ($1.25 million) of both funds are reserved for businesses in census tracts with poverty rates of 30% of greater, or median family income at or below 60% of area median income.

How much money can a business receive?

- Up to $10,000 in a grant, based upon the business’s payroll

- Independent contractors do not count as employees.

- Up to $50,000 in a loan, depending on the business’s payroll and ability to repay the loan

- Loans will have interest rates of 0-1%, can be paid over 5 years, and payments can be deferred for up to 12 months.

- Businesses can apply for either a grant or a loan, not both.

Which businesses qualify?

- Geographically located in the City of Dallas

- Have been in existence for at least six months (since Sept. 1, 2019)

- Can demonstrate losses of 25% or more during the crisis

- Must benefit a low-to-moderate income community or create a low-to-moderate income job

How does a business apply?

- Visit dallascityhall.com starting Monday, May 4 at 9 a.m.

- Applications must be completed by Monday, May 11 at 11:59 p.m.

- For questions or help with the process, call 469.749.6500, email sbcf@dallascityhall.com or visit dallasecodev.org.

What documents are needed to apply?

- IRS form W9

- Documents supporting number of employees and payroll (such as IRS form 941)

- Registration with the Secretary of State or County

- Profit and loss statement from the previous year

- Tax statements from 2019 or 2018, including sales and use tax

How and when will money be distributed?

- After the May 11 application deadline, the city will conduct two lotteries, one for all city businesses and one for businesses in what are considered high-distress areas. The city will verify documentation needed to qualify, and funds will be distributed at the beginning of June, according to Courtney Pogue, Dallas’ director of economic development.

Leave a Reply