Story by Sujata Dand and Jeffrey Ruiz

When Karina Portillo walked into the Wesley Rankin Community Center in West Dallas for help protesting her property taxes, she didn’t know what to expect.

Her grandmother heard about the event at Casa Feliz, a program at Wesley-Rankin for senior citizens. She asked Portillo to attend because they could use some help reducing their property taxes.

Portillo’s grandfather, Juan Portillo, bought the home on Gallagher Street in 2017 with help from Builders of Hope. In the last five years, the property value has more than doubled.

“It’s not a lot. But a couple of hundred dollars for them is a lot,” Portillo says. Her grandmother doesn’t work and her grandfather is retired. “I went for them.”

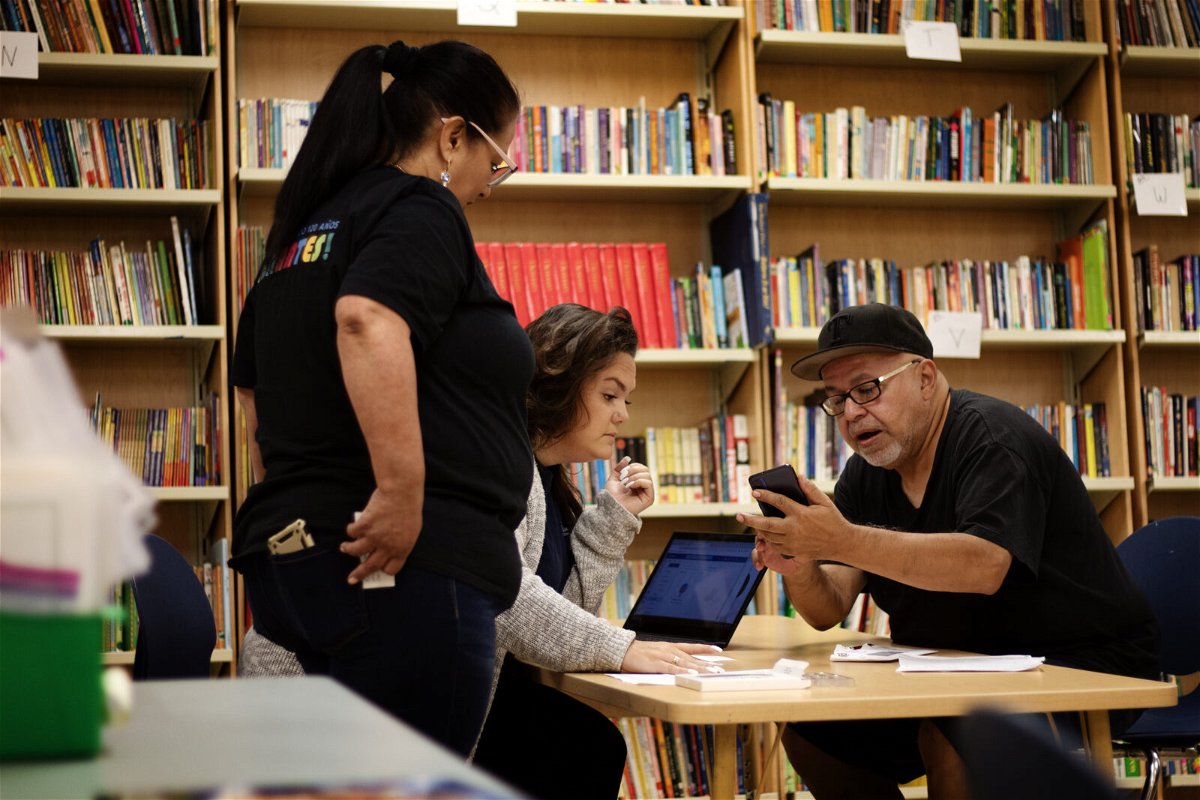

Property tax consultant Toby Toler met with Portillo and more than 20 other Dallas County residents at Wesley-Rankin that day.

“Ninety-five percent of the people in Highland Park protest their taxes,” Toler says. He’s been in the business of protesting taxes for clients for more than 40 years. Since 2018, he’s been helping residents in South Dallas and West Dallas for free. “Here, 95% don’t protest their taxes.”

Toler worked with 36 people at Wesley Rankin over two days, walking them through the protest process on Dallas Central Appraisal District’s (DCAD) website.

DCAD is the agency charged with appraising each parcel of land in Dallas County “accurately, fairly and equitably.” Each year, the agency assigns a property value, and Dallas Independent School District, the City of Dallas, Dallas County, Dallas College and Parkland Hospital each collect a percentage of that value from residents to fund their budgets.

“The system is basically upside down because to protest, you have to go in and prove them wrong instead of going in and talking to them and making them prove to you that they’re wrong,” he says.

Portillo says Toler wasn’t able to do much for her grandparents. They had already filed a homestead exemption — a tax benefit for people who both own and live in their home, which gives a percentage discount on the taxable value of the property and in turn lowers the amount of property taxes that must be paid annually. However, Portillo, herself, had not filed a homestead exemption.

“This past year, my taxes literally doubled. The taxes skyrocketed!” she says. “It was close to $5,000.”

Portillo bought her home in West Dallas in 2019. The 1950s cottage is about 1,400 square feet. Toler helped her file a homestead exemption and also helped file a protest to lower the valuation of her home. Portillo has not renovated the house since she moved in.

Toler submitted pictures of the condition of Portillo’s home to the Dallas Central Appraisal District website. With a few clicks on the computer, Toler was able to challenge DCAD’s valuation of her house.

“Typically the condition of the house is the mystery for DCAD,” Toler explains. “As you go down the scale of quality or condition of a home, you get it to a lower value.”

Toler says that when he submits a protest to change the status of a house from “average to fair or poor,” it typically stays that way in DCAD’s system, and creates a precedent for the home value in future property tax bills.

Unfortunately, Toler says, there’s not much he can do when it comes to how the land is valued.

“They try to be at the low end of land,” Toler explains. He says the land evaluations are generally very fair, and difficult to argue.

“They cannot give individual appraisers the ability to change a land value because it affects an entire neighborhood. It could affect hundreds, if not thousands of homes. So if you change one, you have to theoretically change the model. They’d have to go back and redo the world,” Toler says.

So, when land values increase rapidly, Toler says, there may be less to gain by protesting your taxes.

“Back in 2016, a West Dallas lot was eight or nine thousand bucks on the tax roll. Now it’s $180,000 on the tax roll,” Toler says.

Even with the homestead exemption, that’s a 1200% increase in property taxes in less than 10 years. (see below)

Property Taxes for homes valued at $8000

| City | School | County and School Equalization | College | Hospital | Special District | |

| Taxing Jurisdiction | DALLAS | DALLAS ISD | DALLAS COUNTY | DALLAS COLLEGE | PARKLAND HOSPITAL | UNASSIGNED |

| Tax Rate per $100 | $0.7458 | $1.184935 | $0.227946 | $0.115899 | $0.2358 | N/A |

| Taxable Value | $8000 | $8000 | $8000 | $8000 | $8000 | $0 |

| Estimated Taxes | $60 | $95 | $18 | $9.27 | $18.86 | N/A |

| Tax Ceiling | N/A | N/A | N/A | N/A | N/A | N/A |

| Total Estimated Taxes: | $201.13 | |||||

Property Taxes for homes valued at $180,000

| City | School | County and School Equalization | College | Hospital | Special District | |

| Taxing Jurisdiction | DALLAS | DALLAS ISD | DALLAS COUNTY | DALLAS COLLEGE | PARKLAND HOSPITAL | UNASSIGNED |

| Tax Rate per $100 | $0.7458 | $1.184935 | $0.227946 | $0.115899 | $0.2358 | N/A |

| Taxable Value | $180,000 | $180,000 | $180,000 | $180,000 | $180,000 | $0 |

| Estimated Taxes | $1342.44 | $2132.88 | $410.30 | $208.62 | $424.44 | N/A |

| Tax Ceiling | N/A | N/A | N/A | N/A | N/A | N/A |

| Total Estimated Taxes: | $4,518.68 | |||||

Property Taxes for homes with homestead exemption

| City | School | County and School Equalization | College | Hospital | Special District | |

Estimated Taxes with homestead exemption | $1073.95 | $734.66 | $328.24 | $166.89 | $339.00 | N/A |

| Total Estimated Taxes: | $2,643.29 | |||||

“So just think proportionately — if you had that effect on anyone’s home, what it would do to their budget. There’s been some tragic stories of folks that just got squeezed,” Toler says.

“I walked in and Toby was holding this woman’s hand,” says Shellie Ross, executive director of Wesley-Rankin.

She says Toler has a way of gently explaining to homeowners how to protest their property taxes. However, Ross says, the rising land values in West Dallas have made it difficult to get more than a few hundred dollars back as opposed to thousands of dollars like in years past.

Things aren’t that different in South Dallas. Dr. Teresa Jackson lives in Mill City. The land value increased from $30,500 to $50,000 in one year.

“I was shocked when I opened up the letter saying how much the estimated taxes were going to be,” says Dr. Jackson. She has lived in her home since 2003.

In the last three years, the land has increased in value by 5 times.

“My property is something that I want to keep, and as the property taxes go up, that impacts when I can retire, and all of those things. It creates a lot of anxiety,” Jackson says.

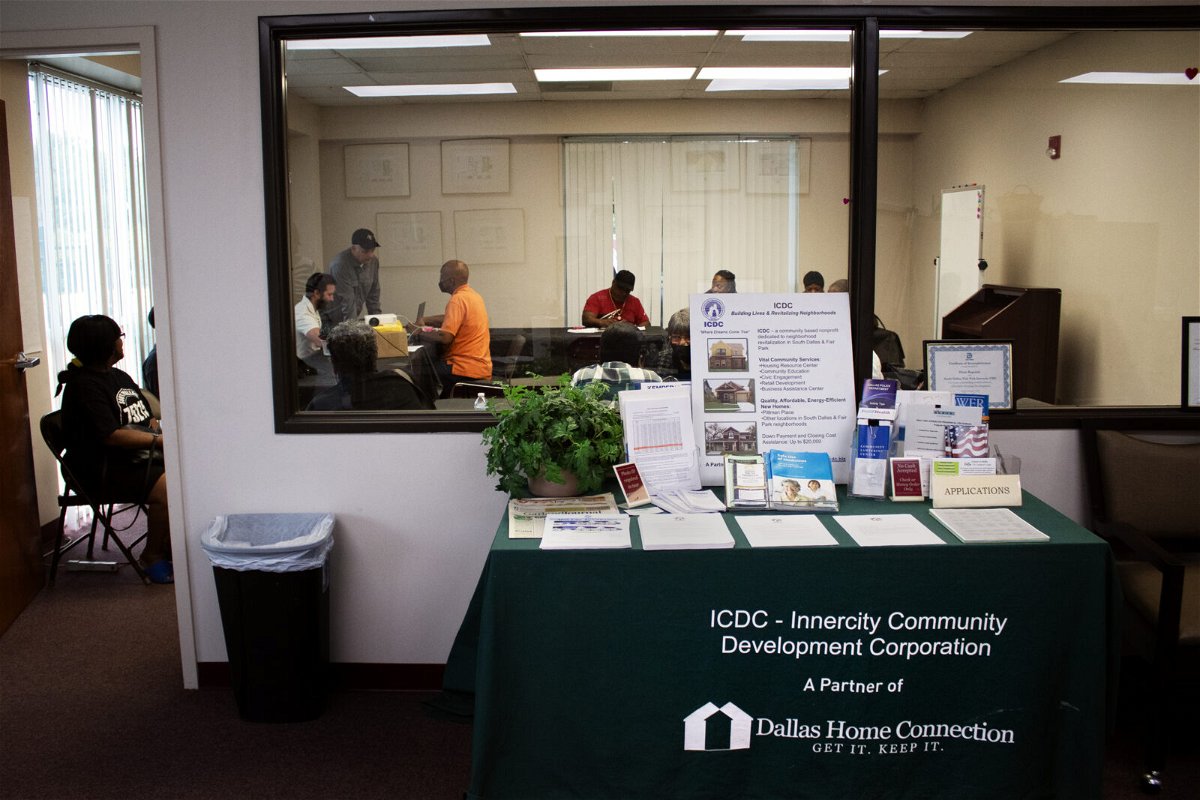

That’s why former South Dallas City Councilwoman Diane Ragsdale asked Toler to come to her organization, Innercity Community Development Corporation (ICDC), to help neighbors there protest their taxes this spring. He says he helped about 20 people there. Toler also met with 50 people over three days at Red Bird Mall. In total, he did six clinics seeing more than 100 people.

Ragsdale says she protested her property taxes years ago, but the reason she organized the event is she hopes that Toler can help stabilize South Dallas before property values go through the roof.

“We want to make sure they are not priced out because of the taxes,” she says.

Ragsdale says most of the people who are served in her neighborhood are moderate or low-income individuals.

“People have complained about taxes really skyrocketing,” Ragsdale says. “Our role here is to assist people to really manage those taxes and protest those taxes appropriately.”

Toler also worked with South Dallas residents through Frazier Revitalization, and was recruited to an event at Redbird Mall to do the same in Southern Dallas. All in all, he worked with more than 100 people over DCAD’s four-week protest period in April and May, and says he feels like the majority of the people he helped were able to successfully challenge their property values and lower their taxes.

“I feel very hopeful,” Dr. Jackson says. “I’ve done this process by myself and it’s very frustrating and overwhelming.”

In West Dallas, Portillo says she’s expecting a refund of a couple thousand dollars. She recently contacted DCAD and was told they had received her paperwork, but they hadn’t processed it yet.

“It was approved for the cost to come down,” she said. “But, they are backed up for about 90 days. I just have to play the waiting game now.”

Leave a Reply